Late payments are one of the biggest financial stressors for small businesses. Whether you’re a freelancer, a consultant, or a growing company serving clients across Toronto, waiting on overdue invoices can disrupt cash flow, delay payroll, and make it harder to plan for the future.

The reality is that late payments happen often. Some clients simply forget. Others prioritize other bills before yours. And in some cases, businesses deal with disorganized accounts payable departments. No matter the reason, unpaid invoices place unnecessary pressure on small business owners who are already juggling operations, sales, and financial management.

This is where strong accounts receivable (AR) practices make all the difference. With the right processes in place and the right support behind you, late payments become manageable rather than overwhelming. If you’re looking for late payment solutions for small business, this guide will help you understand why clients delay payments, what you can do internally to prevent it, and how to stay on top of overdue invoices without damaging relationships.

Why Do Customers Pay Late? Common Reasons Small Businesses Should Know

Before you address the problem, it helps to understand why late payments happen. Most overdue invoices fall into a few common categories.

1. Disorganized internal systems

Some clients don’t intentionally delay payments. Their accounts payable system may be slow, outdated, or overly manual. In these situations, even simple invoices can get lost, misplaced, or pushed to the bottom of someone’s inbox.

2. Incorrect or unclear invoices

A surprising number of overdue payments are caused by missing details, errors, or unclear billing terms. If your invoice lacks a PO number, item breakdown, or due date, it increases the chance it gets pushed aside.

3. Cash flow issues on their end

Your client may be dealing with their own financial constraints. When cash is tight, businesses tend to pay vendors later than usual. Unfortunately, small businesses often end up at the bottom of the priority list.

4. Lack of follow-up

If a business doesn’t follow up promptly, some clients interpret it as flexibility. Others simply assume the invoice wasn’t urgent.

5. Confusion around payment methods

Some customers prefer credit cards. Others prefer e-transfers. If your preferred method isn’t convenient for them, it may cause delays.

Knowing these reasons helps you tailor your approach. And the good news is that many late payment issues can be avoided with the right structure and proactive communication.

The Impact of Late Payments on Small Businesses

Late payments may seem like a small inconvenience, but the effects run deeper. For small businesses in Toronto, consistent late payments can affect:

Cash Flow Health

Your ability to pay your suppliers and employees depends on timely payments from your clients.

Stress and Burnout

Chasing overdue invoices consumes time and drains energy you could be spending on growth.

Business Opportunities

When cash flow is unstable, small businesses hesitate to take on new projects, hire help, or invest in marketing.

Credit and Vendor Relationships

Delays in your incoming payments can cause delays in your outgoing payments, damaging professional relationships.

The good news is that you can take back control of your accounts receivable with clear processes, tools, and follow-ups.

Practical Late Payment Solutions for Small Businesses

Here are real, actionable strategies small businesses in Toronto can implement. These solutions help you manage overdue invoices without harming customer relationships.

1. Strengthen Your Invoice System

A good invoice is clear, complete, and easy to process.

What your invoice should include:

- Your business name and contact information

- Client information

- Invoice number and date

- Clear outline of services or products

- Payment terms (Net 15, Net 30, etc.)

- Due date

- Multiple payment options

- Late fee policy (optional)

Pro Tip for Toronto Businesses:

Make sure your invoice reflects local tax requirements such as HST status and your business number. Missing HST details often cause delays, especially for larger clients.

2. Set Firm, Clear Payment Terms

Your payment terms should set expectations from the start.

Common terms include:

- Net 15 (payment due in 15 days)

- Net 30

- Upon receipt

- Milestone-based billing

Small businesses often default to Net 30 because it feels standard, but shorter terms can improve cash flow.

Helpful Tip:

Discuss payment terms upfront, not after delivering the service. Clients are more likely to accept shorter timelines when expectations are set early.

3. Send Invoice Reminders Before and After Due Dates

Clients appreciate reminders. Consistent follow-up also signals professionalism.

Sample Reminder Schedule:

- 3 days before due date – Friendly reminder

- On the due date – Quick check-in

- 7 days after due date – Polite follow-up

- 14 and 21 days after – Firm reminders

- 30+ days – Final reminder and next steps

Using automated reminder software can save hours and remove the stress of manually tracking due dates.

4. Offer Multiple Payment Options

The easier it is to pay you, the faster payments come in.

Consider offering:

- E-transfers

- Credit card payments

- Online payment links

- Bank transfers

- Direct debit (pre-authorized payments)

If you serve clients who prefer corporate payment portals, make sure your invoicing system is compatible.

5. Collect Deposits or Progress Payments

Deposits reduce the impact of unpaid invoices. They also filter out clients who may cause payment issues later.

Examples:

- 30% deposit upfront

- 50% deposit, 50% upon completion

- Monthly recurring payments

This method is especially useful for freelancers, consultants, contractors, and service-based businesses.

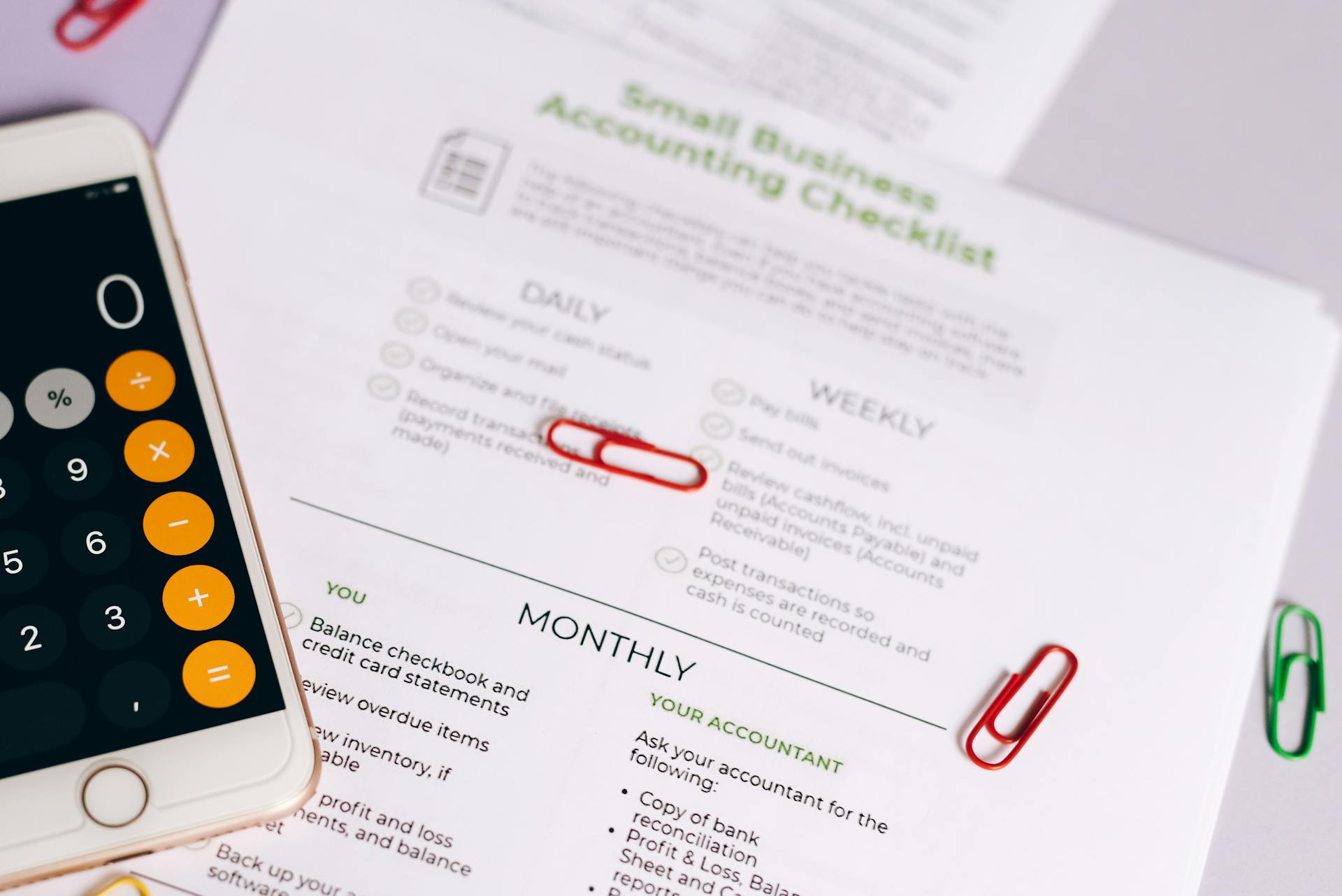

6. Implement a Structured Accounts Receivable Workflow

Many late payment problems come from inconsistent follow-up.

Your AR workflow could include:

- Invoice creation

- Automated reminders

- Weekly AR review

- Clear escalation process

- Documented communication timeline

Even small businesses benefit from a simple system. It brings structure, reduces guesswork, and ensures nothing falls through the cracks.

7. Encourage Early Payments With Small Incentives

This approach works surprisingly well.

Possible incentives:

- 1%–2% discount for payments within 7 days

- Waived admin fees

- Priority scheduling for repeat clients

It’s a small financial trade-off for improved cash flow.

8. Charge Late Fees When Necessary

Late fees help reinforce the importance of paying on time. However, this strategy is best used with clients who repeatedly miss deadlines.

If you choose to add late fees:

- Check that your contract mentions them

- Ensure your fees are reasonable

- Apply the policy consistently

Late fees should be a last resort, not the first step.

9. Improve Client Communication

Sometimes, the fastest late payment solution is simply asking the client what is going on.

Questions to ask:

- Did you receive the invoice?

- Is there any information missing?

- Is there a specific approval chain it needs to go through?

- Do you require a revised format?

This small step helps you identify issues early.

10. Track Payment Habits

Identify clients who consistently pay late and update your processes accordingly.

You can:

- Shorten their payment terms

- Require deposits

- Enforce stricter follow-ups

- Adjust pricing to account for administrative time

A simple spreadsheet or accounting software report is enough to reveal patterns.

11. Use AR Software or Automation Tools

Technology reduces errors and speeds up collection. Many Toronto small businesses rely on:

- QuickBooks

- Xero

- Wave

- FreshBooks

- AP/AR automation software

These tools offer dashboards, reminders, payment tracking, and simple report generation.

12. Outsource Your Accounts Receivable for Stronger Results

Managing AR yourself is doable, but it becomes harder as your business grows. Outsourcing ensures:

- Faster follow-up

- Professional invoice handling

- Reduced errors

- Clearer communication with clients

- Stronger internal controls

- More predictable cash flow

Most importantly, outsourcing frees up your time.

Toronto small businesses often choose outsourced AR services because they provide immediate structure and long-term stability.

When to Consider Outsourcing Your Accounts Receivable in Toronto

You should consider outsourcing if:

- You spend too much time chasing invoices

- Cash flow is unpredictable

- Your invoices are often paid late

- You want a consistent follow-up process

- You need accurate reporting

- You don’t have the staffing capacity to manage AR in-house

An expert AR team improves not only your cash flow but also your client relationships.

G. Scalable Support as Your Business Grows

Small businesses often experience ups and downs in workload. Outsourcing AP provides flexibility because you get support that grows as your needs grow. Instead of hiring more staff or investing in expensive software, you simply scale the service.

Whether your business processes 20 invoices a month or 200, outsourced AP adapts without interruption.

Final Thoughts: You Don’t Have to Manage Late Payments Alone

Late payments are frustrating, but they don’t have to become the norm. With clear invoicing, strong processes, consistent follow-up, and the right support, small businesses can take control of their accounts receivable and build healthier financial systems.

If late payments are affecting your cash flow, it may be time to get specialized help.

Work With Good Monday — Your Accounts Receivable Partner in Toronto

Good Monday offers expert Accounts Receivable Service in Toronto, helping small businesses manage invoicing, follow-ups, reminders, and cash flow with confidence.

Work with a trusted accountant, business advisor, consultant, or CFO service to strengthen your financial systems and keep your business running smoothly.

Published by Vira Marketing.